Invest With The Wind At Your Back:

Value Investors Should Avoid U.S. Stocks

Running with the wind at your back is still running, but it’s a lot easier than running into the wind.

The same is true with investing.

The wind at your back is buying cheaply.

Today we’re going to look at the cheapest markets in the world from charts published by GMO, a major investment management firm.

The firm – formerly Grantham Mayo & Otterloo (GMO) – was founded in 1977.

It has been through all the major ups and downs in the markets.

The firm is in it for the long term.

That’s why it focuses on expected future returns from all assets classes.

And, for regular investors, it publishes this data in chart form.

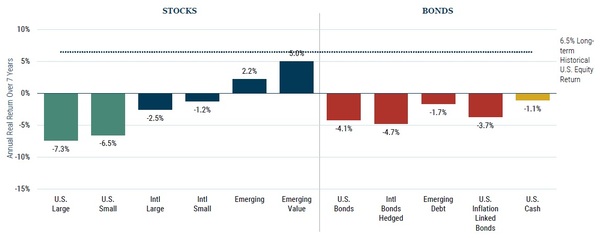

For example, here’s a chart of the firm’s 7-Year Asset Class Forecast Q4 of 2021 when the “bubble in everything” was just topping out:

This chart shows the market conditions perfectly.

Everything was so richly valued that the expected future returns were negative nearly across the board.

That’s what played out in 2022 as well.

U.S. large and small cap stocks and bonds across the board got whacked.

But here’s the thing.

The correction in 2022 was so deep that the expected returns for many asset classes actually turned positive.

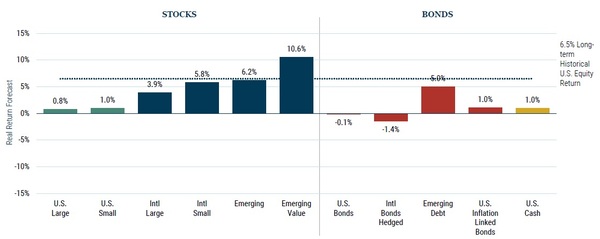

You can see this in the firm’s 7-Year Asset Forecast for from Q3 2022 when stocks were bottoming out:

Expected returns flipped from massively negative to positive with one swift correction.

Although not everything was cheap enough to offer big potential (i.e. U.S. large cap stocks which were expected to deliver less than 1% per year), it was a major turn.

That brings us to today.

The rally has been strong, but that’s causing expected returns to change again.

Consider the 7-Year Asset Class Forecast from May 2023:

The expected returns have dropped significantly after the rally.

The U.S. large and small-caps are now expected to go down over the long run from here.

But not all is lost though.

Emerging markets are still expected to offer above-average returns for years to come.

This asset class forecast is not a perfect predictor of markets.

But it does show where the values are with the highest payoffs and probabilities of success.

Right now that’s not in U.S. stocks, but in emerging markets stocks.