Investor’s Guide To Europe’s Energy Crisis

Featured: Two Companies Taking Off From Alleviating Catastrophic Power Problems

Dear Dynamic Wealth Reader,

This winter the European energy crisis could slide into something far worse.

It’s already bad and temperatures are mild.

Natural gas and electricity prices were already up as much as 1,000%.

Russia announced the Nord Stream 1 gas pipeline would be shut indefinitely.

European stockpiles of natural gas are only at about average levels.

They’re importing record coal from any country that can export.

And again, winter is still not even here.

This is a situation that could go from bad to catastrophe in one cold snap.

Economic mayhem is a certainty with factories cutting hours, restaurants closing down, and the entire economic bloc heading for a potentially huge decline in GDP.

But here’s the thing.

Some companies are expanding aggressively to provide viable solutions to alleviate some of the crisis and could make early investors a fortune.

We’ve featured a couple of those companies in this report.

And you’ll learn all about them – including names, ticker symbols, and how they’re positioned to benefit greatly from high energy prices in Europe – but first we start at the beginning.

Europe's Electricity Crisis Is Here

Power prices in Europe have made a parabolic surge.

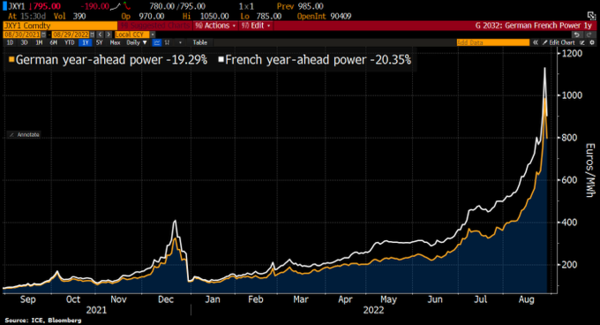

This chart from Holger Zschaepsitz shows electricity prices in Europe:

The chart speaks for itself.

Power prices have soared over the last year to hitting a peak of over 1000 Euros megawatt-hour.

That’s six times higher than the average price.

The impact of this kind of move in something as fundamental as electricity is huge.

To put it in perspective, the average residential power consumer uses a little under one megawatt-hour per month.

So the average monthly power bill will go from somewhere around $150 to $1000.

That’s bad enough for consumers.

But businesses and industries that use it many times that amount of power will get crushed.

They won’t be able to afford to stay open. But many won’t be able to afford to stay closed either.

There’s no place to hide from it all.

Worse yet, the high prices aren’t going away anytime soon.

But before we get into what’s driving this epic surge (it’s multiple systemic factors that can’t be changed cheaply or quickly), you have to understand something about the energy markets that make them extremely attractive to investors in times like these.

No Better Bet Than Energy When Wind Is At It's Back

When times are good in energy, they’re great.

When times are bad, they are dreadful.

Right now is looking to be one of the good times especially in Europe.

But the key here is that these prices may be high, but they can stay high for a long time.

That’s because even small changes in supply or demand can cause wild swings in energy prices.

Just look at the oil boom in the 2000s.

Oil started the decade at a multi-decade low of around $10 per barrel.

By 2008 the oil price surged to more than $100 per barrel.

The 10x price move in oil was driven by a moderate increase in demand.

Back in 2000 the world consumed 76 million barrels per day.

By 2007 the world was consuming 87 million barrels per day.

The total increase was 14%.

The rise in demand was enough to send oil prices from $10 to around $100 on average.

That’s how sensitive energy markets are to supply and demand.

But it’s just one example.

The reverse happened in 2020.

During the March 2020 pandemic sell-off, oil prices truly collapsed.

The world was consuming about 98 million barrels of oil per day in 2019.

The shutdowns and economic mayhem in 2020 sent the average oil consumption down to 89 million barrels per day.

That’s about a 10% drop in demand.

That modest drop, however, was enough to send oil prices plummeting from $80 a barrel to around $30 average.

It all just goes to show you how energy markets can make crazy swings.

A little bit of demand increase or decline, a supply disruption, or anything can send prices moving up and down big.

That’s where Europe’s soaring electricity prices come in because demand is largely static and new supply sources are going to be ramped up.

Just look at the breakdown of the subsegments of European electricity production to see why the supply side of the equation is not going to rebound anytime soon.

Russia Is Playing To Win

In 2021 the EU consumed 2,830 terawatt-hours of electricity from well-diversified sources.

No single major power source provided more than 25% of Europe’s energy production.

Nuclear power is the largest source and accounts for about 25% of this power.

Wind and solar accounted for about 19% combined.

These power sources are almost completely controlled domestically.

It’s the other power sources – natural gas which is 19% and coal which is 15% – that are creating the crisis because Europe is extremely reliant on foreign sources of fuel.

First, we’ll look at coal because it’s easier.

You can ship coal in from anywhere.

Europe is doing exactly that. Aggressively.

Reuters analysed shipping data and found EU coal imports are surging this year.

The EU has imported 1.2 million tonnes of coal from Colombia, a 318% increase. Imports from Australia set a new all-time high in June. Imports from the U.S. are up 27%. Europe even turned to South Africa where it didn’t import any coal to more than 800,000 tonnes in June.

Europe is getting coal from everywhere because its former top provider – Russia – isn’t shipping nearly as much.

In August 2021 the EU officially banned imports from Russia, which previously provided 70% of the coal used to power coal-fired power plants.

So basically, coal power, which Europe uses to get 15% of its power is drastically curtailed. It is racing to ship in as much as it can.

That’s a problem. But the world has a lot of coal. And a lot of coal shipping capacity too.

The real problem is natural gas.

As mentioned above, Europe relies on natural gas for 19% of its electricity.

But natural gas can’t be shipped nearly as easily as coal.

Natural gas comes mainly through pipelines.

Russia supplies 40% of the EU’s natural gas and Russia has been fiddling around with exports for months.

One of the main pipelines is called Nord Stream 1.

Nord Stream 1 is an undersea pipeline in the Baltic Sea which ships gas from Vyborg, Russia to Griefswald, Germany.

This pipeline is a major source of natural gas to the EU and Russia is using it.

Over the summer Russia announced that from July 11th to July 21st for “annual maintenance”

Ok, maybe that is a regular thing.

Pipelines – especially large undersea pipelines – need a lot of maintenance.

But it was still suspicious.

But it wasn’t just suspicious anymore a month later.

Because Russia announced it would be shutting down the lifeline of natural gas once again from August 31st to September 2nd for more “routine maintenance.”

Then, before it reopened, Russia announced it would be shut indefinitely.

Russia is clearly playing hardball.

And the impacts are already being felt directly by natural gas-fired power plants throughout Europe as natural gas prices have exploded.

But where there’s a problem, there’s a solution.

The Potential Solutions

This case – although no solution will likely create immediate relief – has solutions too.

The options are limited though.

The most obvious solution would be to ramp up fracking.

Like in the U.S. did when Hurricane Katrina sent natural gas prices soaring, fracking provides an urgent and much needed boost in production.

The process turns dormant reserves into natural gas.

To say the least, now would be an ideal time to start fracking in Europe too.

Fracking, however, is largely banned in Europe and it’s not likely to change anytime soon.

Bloomberg sums it up best:

Europe’s got more recoverable shale gas than the U.S., according to estimates, yet there’s been little exploration. Germany, France, the Netherlands, Scotland, and Bulgaria all effectively fracking.

Regardless of what you may think about and how much obvious sense it makes, that option is off the table.

That’s where there are two other potential solutions to alleviate the crisis right now.

The first solution is obvious – more domestic natural gas.

And Europe has a lot of natural gas.

Due largely to the vast hydrocarbon reserves of the North Sea, Norway is the 8th largest natural gas producer in the world and the United Kingdom is the 19th.

The Netherland is also a major natural gas producer. It is 17th in the world of natural gas production.

Europe has conventional natural gas and the companies which produce this gas are natural winners in all this.

But that’s just natural gas. There’s another energy source that could become incredibly valuable in Euopre during this crisis.

This solution may seem a bit crazy at first, but it could make a lot of sense (and money!) in the short-term.

I’ll explain more about this in the second company featured below which is a worldwide leader in this highly-renewable and transportable power source.

Top Two European Electricity “Problem Solver” Stocks

Company #1: Vermillion Energy (VET)

Vermillion Energy is an international oil and gas company based in Calgary, Alberta.

It has oil and gas operations all over the world.

We’re focused on the company’s European operations which account for a major part of its revenues.

The Vermillion Investor Presentation provides a lot of the specifics about the company's European operations.

Some highlights include France where the company has two major oil assets in the Paris and Aquitaine Basins which have an estimated 1.7 billion barrels of oil in place.

Vermillion is in Germany too where it plans to drill three new net wells in 2022.

But our main interest is in the vast natural fields of the Netherlands where Vermillion has a big footprint.

As mentioned above, the Netherlands has a lot of natural gas.

Editors at the Energy and Environment of a Euro-focsued website called Euractive go as far as saying: “The Dutch could come to the rescue for Europe’s energy crisis.”

They further point out that, “Few people know that Groningen — a green northern province of the Netherlands — has the potential to weaken Russia’s energy grip over Europe.”

They’re not wrong either.

The Groningen basin contains an estimated 450 billion cubic meters of recoverable natural gas.

That’s enough natural gas to power Europe for well over two years from one field. .

It’s huge and Vermillion has a sizable stake in Netherlands’ vast natural gas reserves too.

Since 2012 Vermillion has been steadily adding to its assets in the Netherlands.

The company says it has tripled its land position in the natural gas-producing region of the Netherlands with 800,000 net acres.

Vermillion successfully drilled 17 natural gas wells in the Netherlands, has plans for two more in 2022 on net, and has the land stake to do much more in the future.

Oil and gas is complicated industry with hedging prices, production quality, drilling hits and misses, and so much more.

But the thesis hereis simple.

European natural gas and electricity prices have soared, there aren’t many options to bring them down, and a natural gas producer with a big stake in the heart of it should be ideally positioned to do extremely well.

Vermillion is that company.

Company #2: Enviva (EVA)

Enviva is a company which provides one of the most seemingly absurd energy solutions one could think of in 2022.

Enviva makes wood pellets to burn for electricity.

That’s right – burning wood…for electricity.

My first thought was this is the perfect indicator of how truly desperate Europe has become for non-Russian energy.

Because burning wood for electricity must be one of the most environmentally unsound.

But after starting to look into it, it makes more sense than I thought.

And, more importantly, Enviva is in a strong position to provide the wood needed for electricity.

You see, burning wood for electricity makes sense when you consider how the timber industry works.

The bulk of the trees harvested are for lumber and paper.

The lumber companies go for the biggest trees to most efficiently cut them down.

But with those big trees comes all the bark, small branches, and other parts of the trees that one were basically worthless.

That’s where Enviva comes in.

Enviva takes this discarded wood scrap and turns it into pellets which can be easily transported and burned for power.

Here’s a picture of the wood pellets from Enviva to so you can see:

Enviva even made a video about the process.

It’s aptly called A New Life For Low-Value Wood.

The video has all the markings of a corporate-approved video, but if you’re interested, it’s there.

Now, back to burning wood for electricity.

The energy companies don’t want to say they are burning wood, because it sounds crazy.

So they lump the wood into a category called biomass.

The U.S. Energy Information Administration defines biomass as: renewable organic material that comes from plants and animals.

That includes wood, discarded crops, and manure.

The biggest part is the wood.

Biomass is a pretty big and growing segment of electricity production too.

Today biomass is the fuel source for 5% of Europe’s electricity.

And a large, reliable supply chain of the pellets is becoming increasingly dear.

The Vancouver Sun reports in U.K. power producer increases stake in B.C. wood-pellet industry:

The United-Kingdom-based power producer Drax Group Plc is increasing its hold on British Columbia’s wood-pellet industry with an agreement to buy its eighth production plant in the province.

Enviva is a major producer and exporter of these wood pellets.

Enviva has port operations at Virginia, Alabama, Florida, Mississippi, Georgia, and North Carolina.

These are the ports that take the discarded wood from the vast forestry industry in the Southeastern United States and ship them to Europe.

Enviva generates more than $1 billion per year in revenue.

And that will rise right along with pellet prices because wood pellets are already on the move.

There isn’t much data available to the public, but timber-online.net has posted data from last April.

It showed pellet prices in Europe are up 40% over the last year.

With surging demand, rising inflation, and these being one of the few solutions to Europe’s electricity prices, they could rise even further.

If and when the wood pellet prices rise again, Enviva would be a big winner in it all.

Conclusion

The current situation in Europe is a relatively straightforward investment proposition as they come.

Electricity prices have already soared in Europe.

The companies with the resources to provide the power to Europe at elevated market prices when demand is far outpacing supply stand to make fortunes.

These are a couple of companies which could do just that.

Change has come. Change is accelerating.

At this point, investors will either capitalize on change, growth, and the wealth created by it or pay the high price of being left behind.

Dynamic Wealth Research was founded with the sole purpose of tracking change and singling out the companies driving the change