Free AI Investing Tool Will Make Your Research Faster, Deeper, And Better

AI can make you better.

It’s already increasing efficiencies across so many businesses.

Parcel companies use AI to shorten delivery routes.

Media companies use it to get more viewers.

Doctors are using it to make more accurate diagnoses.

There’s no reason it can’t be used by investors like you to make better investment decisions.

Today we’re going to review one investor-focused AI tool and how you can use it right now to make more informed investment decisions and save you time.

How To Use AI For Stock Market Research

One of the fastest-growing AI tools for investors is Finchat.io.

The web address is for Finchat is: https://finchat.io/chats/

If you’ve even just played around with ChatGPT, you’ll quickly recognize the interface.

You just write prompts and the results flow from there.

Best of all, Finchat is free…with a catch.

Users only get 10 free prompts per day and have to pay for the rest.

But once you realize the power of it, you can see that even 10 free prompts will collate and present you valuable data.

We’ve put together two examples – one good and one bad – of how we used Finchat to research some potentially compelling opportunities.

First was a prompt about oil.

We’ve covered here how investment in oil production has plummeted to multi-decade lows and how some of the world’s best investors see that as a major opportunity.

The prompt we used was:

Q: Why did Warren Buffett buy oil stocks?

The initial response was a standard boilerplate answer about how the service can’t deliver an answer to this question.

But it didn’t want us to go away empty-handed.

So it added a quote from one of Buffett’s shareholder letters:

In 2009, I started buying oil again and oil equities, and I’ve been doing pretty well. But given the status of the world today and the price of oil, I’m questioning my investments. Is this another oil bubble?

Warren Buffett wondering if oil prices are going to crash?

Well, that would be news.

And it was big news in 2011 when that letter was written.

So that wasn’t even remotely helpful.

And it’s why it was a bad example of how to use Finchat.

So we tried again and the results this time saved possibly hours of research time to uncover one simple fact.

This was an opportunity related to investing in AI.

AI requires a lot of computing power.

And the cloud computing companies like Microsoft, Amazon, and others are lining up to provide the processing power.

So we wanted to see how much Azure, the main part of Microsoft’s “Intelligent Cloud” business segment, has become.

Finchat was ready to help.

The prompt we used was:

Q: What percentage does Azure make up Microsoft’s revenues?

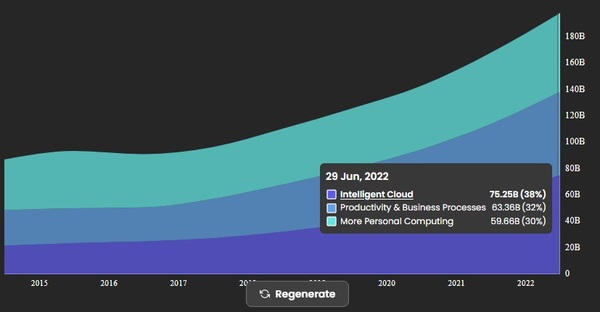

The answer came in the form of a chart that shows exactly how Azure and the “Intelligent Cloud” has become of Microsoft.

We screenshotted the chart below:

The chart shows how the Intelligent Cloud segment has grown from 24% of total revenue into 38% today.

It also showed the decline of personal computing to Microsoft's top line too.

It’s clear Microsoft has and will continue to be a computing giant, but it will come from cloud services and not through its fading traditional business of Windows software products.

Conclusion: Put AI To Work For You

This is just a handful of examples.

The first didn’t go well.

The second, however, would have taken a couple of hours of research to piece together.

Finchat and other companies may not help you make better investments directly.

It’s not going to answer “what is the best stock to buy now?” or anything like that.

But it will give you more time to research investments.

And that alone can go a long way to making you a more successful investor.